Following a March sales surge, Vietnam’s automobile market showed signs of cooling in April with a modest 7% drop in sales. Despite the dip, imported vehicles continue to outsell locally assembled models, reaffirming a growing consumer preference for foreign-made cars.

Vehicle sales in April dipped slightly compared to March. Source: VAMA

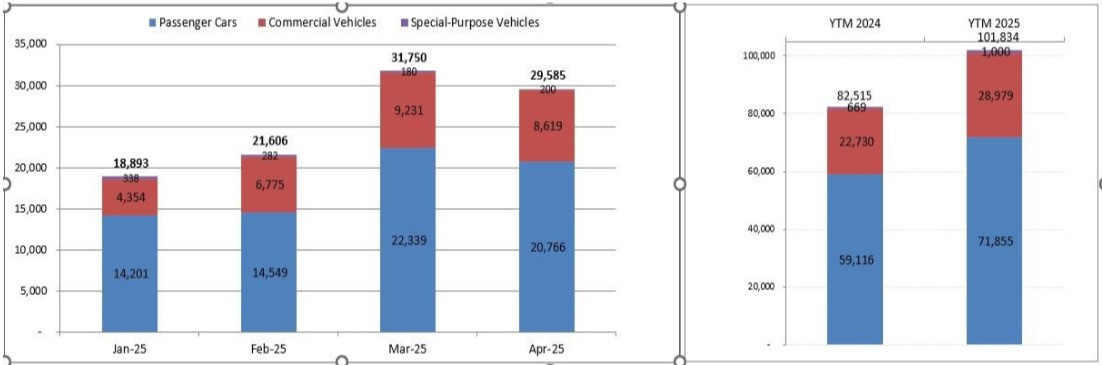

According to the Vietnam Automobile Manufacturers Association (VAMA), its members sold 29,585 vehicles in April 2025, comprising 20,766 passenger cars, 8,619 commercial vehicles, and 200 special-purpose vehicles. Passenger and commercial vehicle sales each fell 7% compared to March, while special-purpose vehicles rose 11%.

From January to April, VAMA members sold 101,834 vehicles, a 23% increase compared to the same period in 2024. Passenger car sales rose 22%, commercial vehicles climbed 27%, and special-purpose vehicles jumped 49% year-on-year.

Despite the overall growth, April’s figures reflect a slowdown following March’s peak, with supply still abundant.

Consumer preference continues to lean toward imported cars. In April, 13,890 domestically assembled vehicles were sold, down 7% month-over-month. In contrast, 15,695 imported units were sold - a higher figure despite a similar 7% decline.

For the first four months of 2025, imported car sales totaled 52,870 units, up 35% year-on-year. Meanwhile, domestic vehicle sales reached 48,964 units, a more modest 13% increase.

This reflects a notable trend: Vietnamese buyers are increasingly drawn to imported vehicles, even as local production scales up.

According to Vietnam’s General Statistics Office, 56,563 new vehicles (both domestic and imported) were added to the market in April, up 4.8% from March. Domestic vehicle production reached 39,500 units, up 3.7% from March and 60% higher than the same period in 2024 - making April the highest production month of 2025 so far.

However, VAMA’s report doesn’t include data from VinFast and Hyundai, two major players whose sales figures are reported independently.

While consumer demand showed signs of plateauing in April, the steady rise in vehicle supply suggests the market remains well-stocked heading into the second half of the year. The gap between imports and domestic vehicles continues to widen, highlighting shifting buyer preferences in Vietnam’s evolving auto landscape.

Hoang Hiep