Public spending is emerging as a vital and urgent instrument to help Vietnam reach its 8% GDP growth target in 2025, especially amid mounting pressure from retaliatory U.S. tariffs on Vietnamese exports.

In a time of global economic uncertainty, Vietnam’s ambitious growth goal is being challenged by significant headwinds. Chief among them is the United States – Vietnam’s largest export partner – which has imposed steep import duties: 25% on steel and 10% on most other Vietnamese goods (excluding copper, gold, semiconductors, auto parts, medical supplies, energy, and unproduced minerals, which retain Most-Favored-Nation status).

This article presents a simple quantitative model to estimate the required level of public spending to sustain Vietnam’s economic momentum and meet the 2025 growth target.

Context and emerging challenges

According to the General Statistics Office, Vietnam’s GDP in 2024 exceeded $476 billion, with exports totaling $405.5 billion and imports reaching $380.7 billion.

Key trade balances include:

With the U.S.: $136.5 billion in exports and only $13.1 billion in imports, resulting in a trade surplus of $123.4 billion.

With China: A trade deficit of -$82.8 billion.

With all other countries: A combined deficit of -$98.6 billion.

These figures underscore Vietnam’s heavy reliance on the U.S. for exports and on China for raw material imports - 84% of which are production inputs. This dual dependence exposes the economy to significant external risks and reinforces the urgency of diversifying supply chains and boosting domestic production capacity.

The article focuses on the short-term role of public spending in meeting the 8% GDP growth target for 2025.

Estimating required public spending

In the face of rising tariffs, if the U.S. imposes an import tax rate of α%, the surplus reduction is modeled as:

Trade surplus loss (THMD) = -136.5 × α/100 (in billion USD)

Domestic demand - consisting of private consumption (C) and private investment (I) - accounts for about 95% of GDP (63% and 32%, respectively). Without sufficient public investment (G) or net exports, aggregate demand would fall short of driving desired growth.

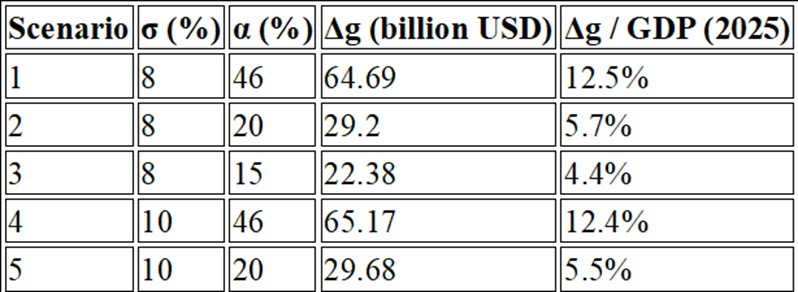

Illustrative spending scenarios and outcomes

If the U.S. imposes a high tariff (α = 46%), Vietnam would need to raise public spending to over 12% of GDP to reach 8%–10% growth - an unsustainable figure under current public debt constraints.

In contrast, if tariffs remain moderate (α = 15%–20%), the required public investment rises to a more manageable 4.4%–5.7% of GDP - feasible provided public spending is used efficiently.

Short-term stimulus, long-term vision

While public spending can effectively stimulate demand in the short run, its success hinges on the outcome of trade negotiations with the U.S. and efficient allocation. Sustained high levels of public spending are unrealistic, so the strategy must focus on smart investment that also strengthens long-term supply capacity.

Priority areas for such investment include:

Healthcare and education

Training and innovation capacity

Total factor productivity (TFP) improvement

These sectors not only drive immediate demand but also build sustainable growth capacity over time.

Balancing supply and demand with domestic focus

Even without additional U.S. tariffs, Vietnam would need public spending equivalent to at least 5% of GDP to support 8%–10% growth. This indicates that relying solely on consumption and private investment (including FDI) is insufficient. A proactive fiscal policy is essential.

Simultaneously, trade policy should aim to reduce deficits with non-U.S. partners - especially China - and improve competitiveness in alternative markets to lessen overreliance on any single country.

Public investment as an urgent lever

Public spending is a necessary and urgent lever for achieving the 2025 growth target in the face of external shocks like U.S. tariffs. However, it must be deployed with precision and discipline to avoid excessive debt burdens.

In the long run, Vietnam’s growth strategy must rest on innovation, productivity, trade diversification, and a stronger domestic market. These are the pillars of a sustainable economic future.

Contributing authors:

Prof. Le Van Cuong (CNRS - Paris School of Economics)

Prof. Nguyen Van Phu (CNRS - University of Paris Nanterre)

Assoc. Prof. Dr. To The Nguyen (University of Economics - Vietnam National University, Hanoi)