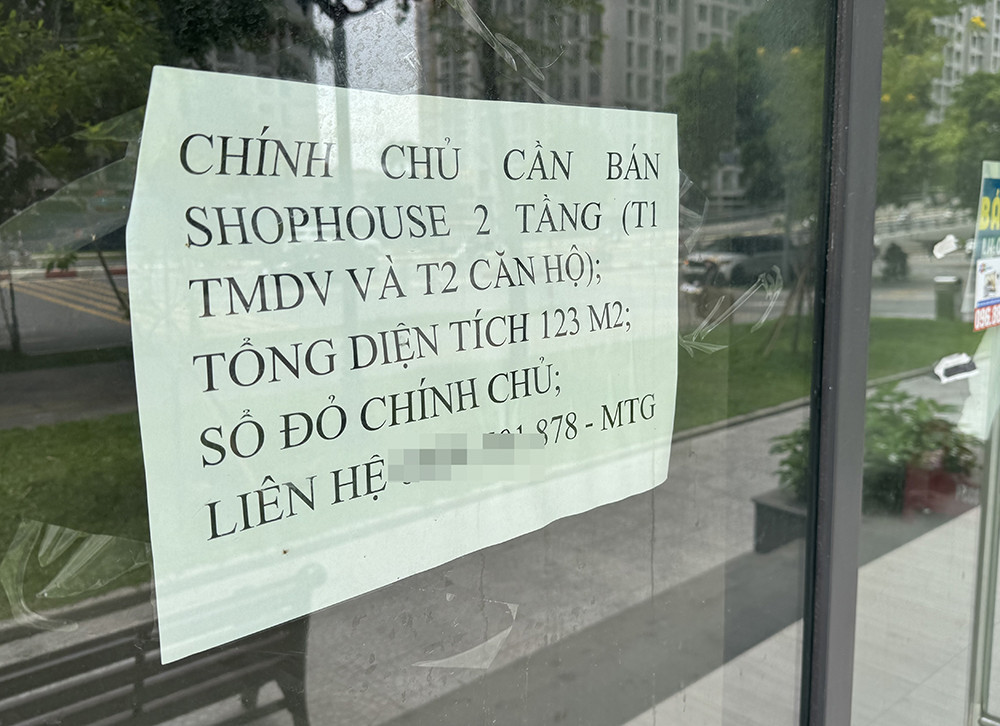

The shophouse purchased years ago for tens of billions of dong by investor Tran The Hung remains vacant. Despite being listed for rent for an extended period, it has yet to attract a tenant.

Invested billions, struggling to earn a few million per month in rent

Mr. Tran The Hung owns a shophouse in a development project in Ha Dong. At the time of purchase, the unit cost approximately 15 billion VND (around USD 590,000). The project was heavily marketed as a “golden goose” - suitable for both living and commercial use with high profit potential.

During the peak of the real estate market, the value of his shophouse rose to 20 billion VND (around USD 786,000). However, it has since dropped, with current prices ranging between 16 to 18 billion VND (USD 628,000 - 707,000). Despite numerous efforts over the past year, he has been unable to sell the property.

To avoid wasting the asset, Mr. Hung decided to list it for rent, but this too has proven unsuccessful.

"Even renting it out for a small sum has been impossible. It's too far from the city center and not viable for business," he lamented.

Dozens of other shophouses in the same project face a similar fate - closed and unoccupied. Only a few units in prime locations near major roads have tenants, typically using them as storage spaces. Rent for these units hovers around 15 million VND/month (USD 590), an amount insufficient to recoup the initial investment, especially for those also burdened by bank loan interest.

With an initial outlay of billions, Mr. Hung finds the rental return negligible compared to a standard savings account. Moreover, factoring in monthly service fees and bank loan interest, investors may even suffer losses.

Some owners are resorting to selling at a loss due to mounting pressure from monthly interest payments.

“I was fortunate not to use bank loans, so the financial pressure is lighter,” Mr. Hung admitted.

Across many projects in Ha Dong, grand European-style shophouses with wide facades sit deserted despite their proximity to major traffic routes. Since handover, only about 30% are occupied, while the rest remain unsold or await resale.

These units are currently listed between 18 to 30 billion VND (USD 707,000 - 1.17 million), while monthly rents range from 15 to 30 million VND (USD 590 - 1,170), depending on their condition.

The problem extends beyond Ha Dong, affecting areas like Hoai Duc, Nam Tu Liem, and Me Linh, where shophouse construction surged during the property boom, leading to oversupply.

Why are shophouses so difficult to sell or lease?

Nguyen Quang Thanh, Sales Manager at Duc Long Company, noted the shophouse market is caught in a speculative bubble. Developers exaggerated their profit potential to justify high prices, but in reality, few are willing to pay such high rents. Ideally, rental returns should be at least 7-10% annually of the shophouse’s value, but current rates fall below 3-4%.

Many new projects lack a sufficient resident base. Shophouses need steady foot traffic to thrive, but no business wants to be the first mover in a ghost town.

“Many sellers are slashing prices, yet liquidity remains low since shophouses are less liquid than apartments,” Thanh explained. He advised investors to consider a mid- to long-term strategy of 3 to 5 years instead of short-term speculation.

According to JLL Vietnam, most investors in shophouses either hope for capital appreciation or plan to use them for personal business ventures, both requiring long-term financial commitment. Thus, only investors with strong capital reserves can hope for a worthwhile return.

From another perspective, Do Thu Hang, Senior Director of Advisory and Research at Savills Hanoi, said shophouses struggle to compete with large shopping centers. Operated independently, shophouses lack the professional management and consistency of malls, affecting their long-term viability.

Moreover, the rigid rental model poses challenges. Tenants often only need the ground floor but are forced to rent the entire building, pushing costs beyond their budgets.

Unlike malls with dedicated teams to manage licensing, technical issues, and compliance, shophouse operations depend entirely on the owner or tenant.

Despite prolonged sluggishness, primary shophouse prices continue to rise. According to CBRE Vietnam, as of Q1 2025, secondary market prices for shophouses averaged 214 million VND/m² (USD 8,400), about 22% higher than for villas and townhouses. Their price growth also outpaced those other segments.

Duy Anh