Nguyen Thi Lan’s garment workshop in Nam Dinh employs five workers, mostly relatives. Each month, the workshop produces thousands of products, generating an average income of VND6-8 million per worker. Yet, it remains a business household, not an enterprise.

“My family has been in this trade for over 10 years. The income is enough to live on, with some savings. Becoming an enterprise seems complicated—bookkeeping, periodic tax reports, and insurance policies for workers. I'm used to doing business in a family style, with freedom, and now I don't want to be tied down," she explained.

Nguyen Thi Hai, who runs a grocery store in Hanoi’s Hoang Mai district, told VietNamNet that her store serves regular customers and brings stable revenue.

“It’s not large enough to set up a company. The tax rate is reasonable. I just pay and move on. If I became an enterprise, I’d need to hire accountants, make financial reports, and pay more taxes, without necessarily earning more. Small-scale trading feels more stable,” she said.

According to the Ministry of Finance (MOF), by the end of 2023, Vietnam had about 5.2 million active household businesses, contributing roughly 30 percent to GDP and employing tens of millions, especially in the informal sector.

A General Statistics Office survey found that in 2021-2023, the average annual revenue of a household business was VND300-500 million. Notably, a significant portion, particularly in food, retail, and small-scale manufacturing, gained revenue exceeding VND1 billion annually.

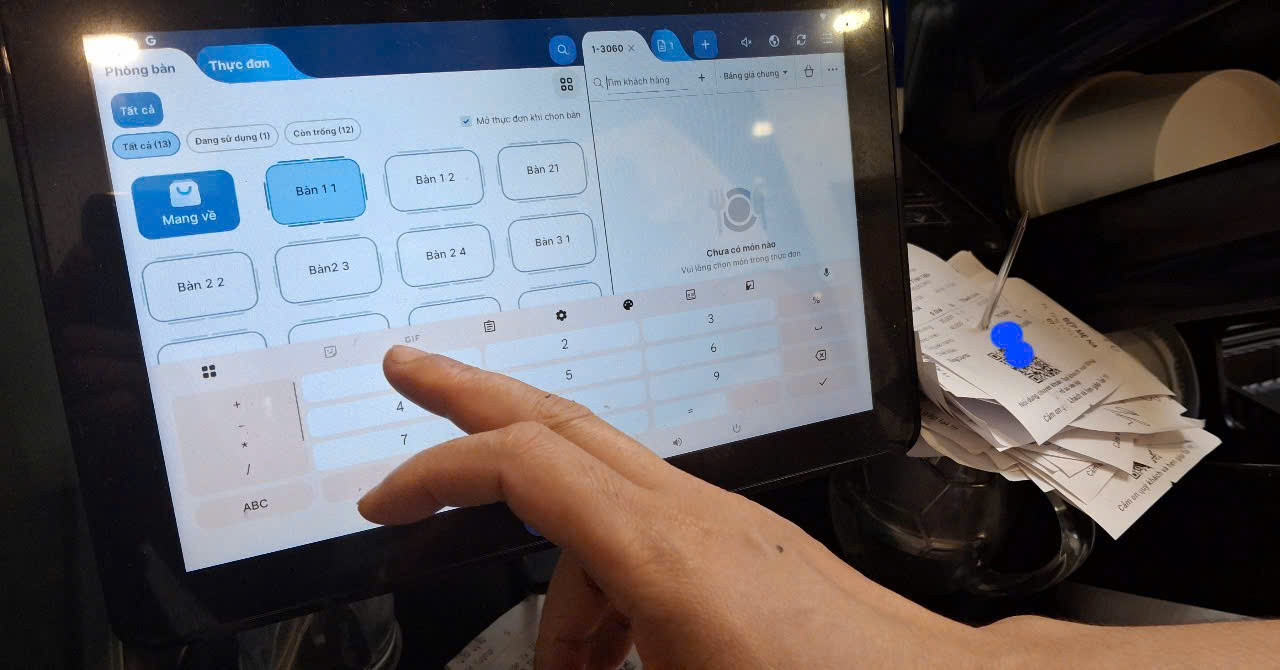

The General Department of Taxation’s latest data showed that 37,000 household businesses have annual revenue above VND1 billion, and have to issue e-invoices generated from their cash registers connected to tax authorities, commencing from June 1. These household businesses are capable of turning into small enterprises.

However, the number of household businesses registering as enterprises remains low. Most operate on a small scale with limited capital and few staff, and lack management skills and technology access.

Additionally, many still don’t have the habit of financial planning or tax compliance, leading to apprehension about the high transparency requirements they will have to observe when becoming enterprises. Many owners maintain a “play it safe” mindset, resisting change, and not fully recognizing the benefits of transitioning.

Nguyen Minh Thao, Head of the Business Environment and Competitiveness Research Department at the Institute for Policy and Strategy Studies, told VietNamNet that the current fixed tax system and ineffective revenue monitoring make many household businesses feel their model is more suitable, causing a hesitation to transition.

When becoming enterprises, business owners must comply with enterprise financial and accounting regulations, regardless of scale. “For very small household businesses, simplified, scale-appropriate accounting rules would provide greater motivation to transition,” Thao said.

She noted that with the current complex accounting system, few household businesses are eager to become enterprises unless they are forced to do this to meet requirements such as e-invoicing or international trade.

Thao also pointed out that regular inspections are a reason behind businesses’ hesitancy to become enterprises. They face more frequent state inspections, increasing compliance burdens.

Meanwhile, current tax incentives, like tax reductions for new small enterprises, aren’t attractive enough.

“Only when a clear legal framework with simplified accounting and procedures is laid down will household businesses be ready to transition,” Thao said.

Addressing bottlenecks

Lawyer Tran Vi Thoai, Director of IBLegal Vietnam Law Firm, noted that household businesses often choose a model suited to their small scale, limited capital, lean staffing, and local focus, with no need for expansion or call for investment.

“Many lack legal knowledge and business management skills, fearing that transitioning will complicate operations and risk legal violations. For stable businesses, they don’t see clear benefits or practical support from transitioning,” Thoai said.

To encourage household businesses to transition, it is necessary to apply practical solutions.

Thao suggested eliminating the fixed tax system and creating tailored accounting regulations for small enterprises. She stressed the importance of rigorous inspections to ensure a transparent, fair business environment.

Thao noted that if business households succeed in transitioning to enterprises, they will operate in a more official, professional environment, expand markets, foster innovation, and gain greater benefits.

“This transition benefits not only household businesses but also the broader private economic sector,” she said.

Duy Anh