At the 2025 Cashless Day press conference on June 2, Pham Anh Tuan, Director of the Payment Department at the State Bank of Vietnam (SBV), said that recent efforts have focused on improving regulations to support the development of cashless payments.

With the State Bank’s legal framework support and upgraded payment infrastructure, results are very promising. In 2024, cashless transaction value reached over VND295.2 quadrillion, 26 times the GDP. By year-end 2024, 86.97 percent of people aged 15 and above had bank accounts.

According to Tuan, compared to 2023 (87.08 percent), the rate of people aged 15 and over having a bank account was slightly lower, however, it was inevitable after going through a process of screening, cleaning data, verifying, and comparing account biometrics.

Previously, Vietnam had 200 million registered bank accounts, but after verification and cleansing, 113 million individual accounts and over 711,000 organizational accounts remain active.

“This is a data cleansing revolution. The total number of accounts is still 200 million, but by September 2025, a legal framework will be set to allow the closure of accounts lacking biometric data to combat fraud and scams,” he said.

“Over the past seven years, we’ve successfully promoted cashless payments, encouraging account openings and usage,” Tuan said.

According to the General Statistics Office (now under the Ministry of Finance), by December 31, 2024, Vietnam had over 69 million adults aged 15 and above, with over 68 million holding bank accounts, reflecting the strong growth of cashless payments.

Tuan said seven “Cashless Day” 2025, initiated by Tuoi Tre (Youth) newspaper, have been organized. This year’s theme is “Cashless Payments Drive Digital Economy Growth”. The message is that cashless payments are not just a transaction method but a strategic foundation for connecting all components of the digital economy.

This foundation enables a cohesive, efficient and evolving digital ecosystem, bringing Vietnam closer to a modern, transparent economy.

Under the 2021-2025 Cashless Payment Development Plan, issued with the Prime Minister’s Decision No 1813, SBV has closely coordinated with ministries, branches and localities to focus great efforts on building and perfecting institutions, laws and organizing implementation; enhancing the application of new technologies, innovating business models, and cooperating to create and provide safe, secure and convenient products and services, bringing added value and outstanding experiences to customers, contributing towards a cashless society.

Outstanding achievements in the payment sector were gained in 2024 and the first months of 2025.

In the first quarter of 2025, the number of transactions via the interbank electronic payment system reached 35,665,760 with a value of VND 81,468,633 billion (equivalent to an increase of 9.60 percent in quantity and 36.81 percent in transaction value compared to the same period in 2024).

Compared to the same period in 2024, non-cash payment transactions increased by 44.43 percent in quantity (via the Internet channel increased by 40.41 percent; via mobile phone channel increased by 39.82 percent; via QR code method increased by 81.64 percent); There were nearly 10.4 million Mobile Money accounts, of which more than 72 percent were in rural, mountainous, remote, border and island areas.

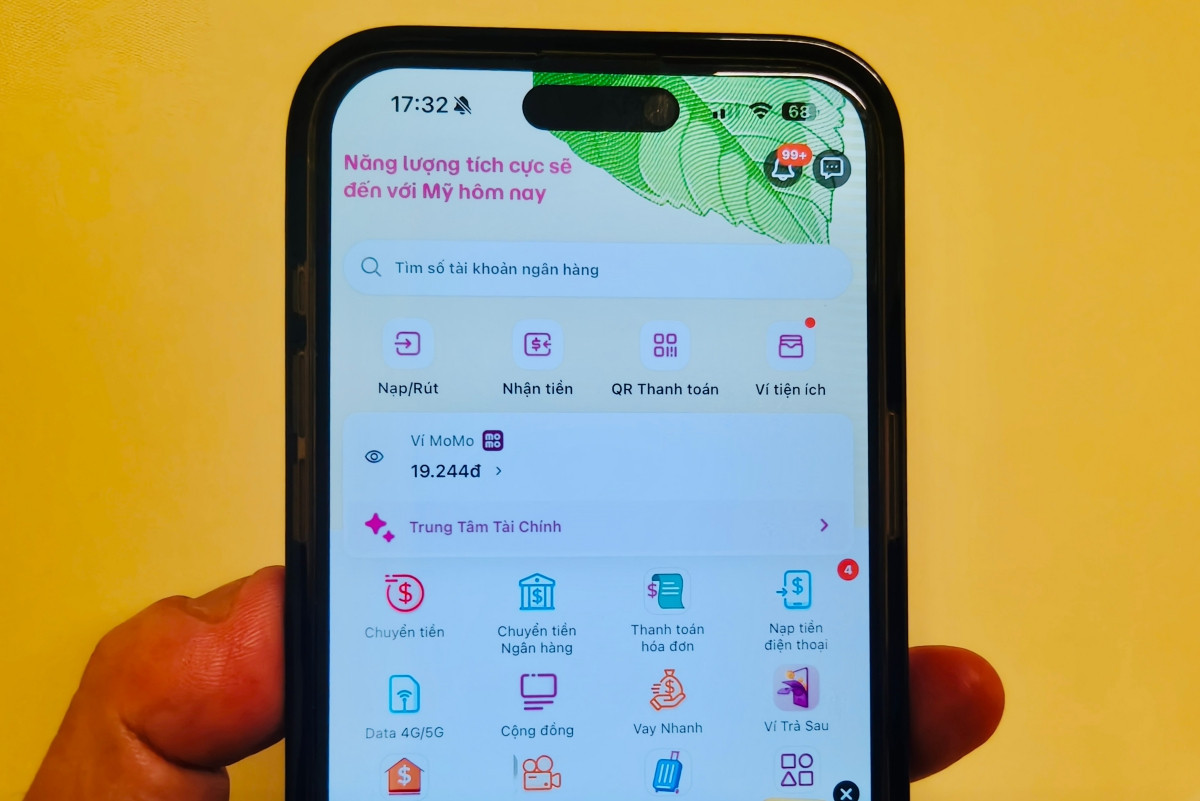

As of March 31, 2025, there were 47 organizations providing e-wallet services. The number of active e-wallets reached 30.27 million (accounting for 65.8 percent of the total of nearly 46.01 million activated e-wallets) with the total amount of money on these wallets being over VND 2.8 trillion.

To ensure security, SBV has collaborated with the Ministry of Public Security to implement Government Project 06. Approximately 57 million loan customer records and over 111.8 million individual customer records have been verified with biometric data against the National Population Database.

Tuan said that from July 1, 2025, e-wallets will officially become a payment method, equivalent to bank accounts, cards, and cash.

Circular 40, recently issued by the central bank, regulates intermediary payment services and introduces measures to advance this sector.

From July 1, 2025, e-wallets will function like accounts, cards, or cash, enabling payments beyond retail, including transfers between e-wallets, from e-wallets to accounts, or vice versa, without requiring linked bank accounts. This creates more opportunities for e-wallets, especially in penetrating markets and providing services in remote areas.

The State Bank is revising Circular 40, expected to take effect from September 1, 2025, to facilitate e-wallet services. However, providers must comply with laws and avoid enabling fraud, scams or illegal activities like black credit, gambling or unauthorized trading platforms.

Nguyen Tuan