In 2019, MISA, a leading information technology company in Vietnam, when surveying small and micro-enterprises, found that 97 out of 100 could not access unsecured bank loans.

The main reasons were insufficient collateral or incomplete accounting records, leading banks to reject applications due to high risks. At that time, digital transformation in banks was in its early stages, with even small loans taking up to a month for disbursement.

With 97 percent of Vietnamese businesses being small or micro, satisfying their lending needs could drive economic growth. This also allows banks to tap into a vast, untapped market.

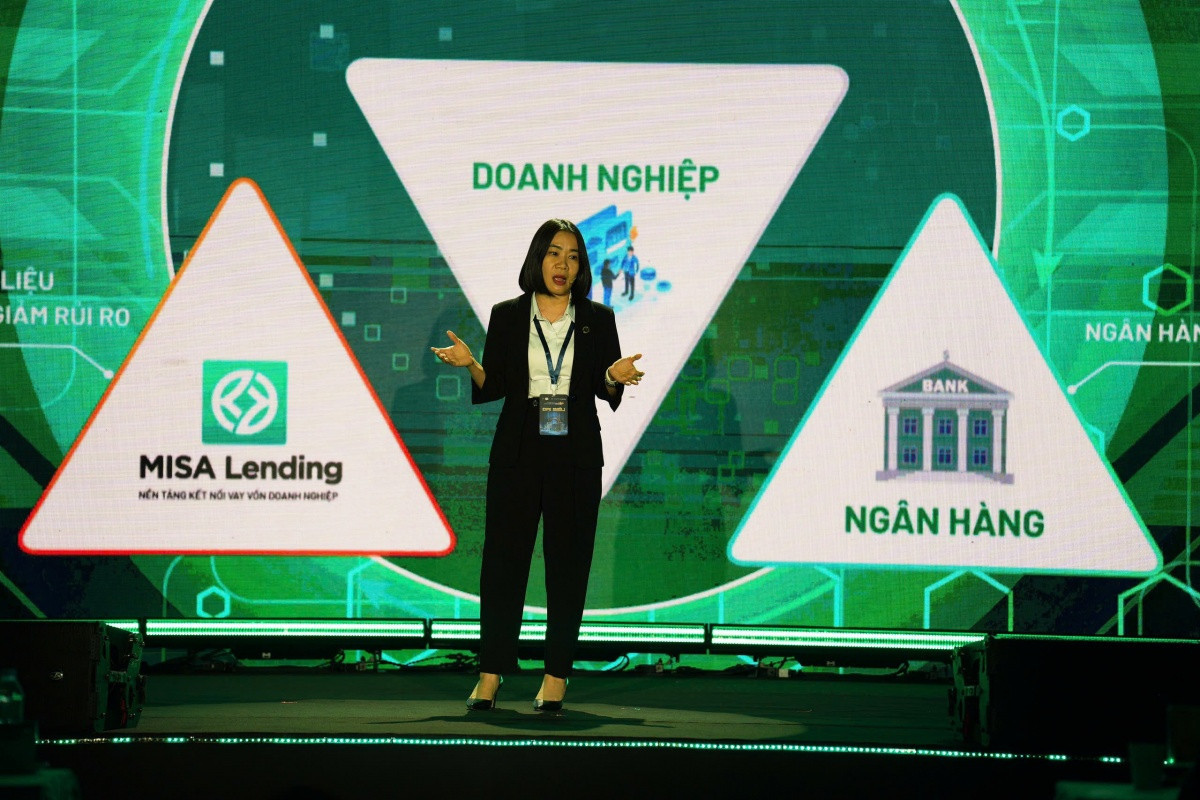

At a recent Banking Digital Transformation event, Nguyen Thi Ngoan, MISA’s CFO, said seizing the opportunity to leverage data as a valuable resource, MISA has developed MISA Lending to connect small and micro-enterprises with banks and credit institutions, facilitating loans through data.

Key metrics for risk assessment are updated and accessible, reducing bank risks.

“Through MISA Lending, VND22,500 billion has been disbursed, with 30 percent of businesses successfully borrowing money, or 10 times higher than traditional methods, and risks are at acceptable levels for banks,” Ngoan said.

At MB Bank, data is treated as a “red book” (land use right certificate), or collateral for unsecured loans.

Vu Hong Phu, an MB executive, explained that businesses with strong cash flow, consistent payroll, and full tax compliance are prioritized for credit without collateral. And the ‘financial history’ of businesses can be ‘seen’ in Big Data.

In 2024, MB granted unsecured loans to over 4,000 businesses based on data, cutting processing time by 80 percent.

“We processed 14,500 disbursements automatically in minutes. Instead of two hours traditionally, each now takes 5–15 minutes, saving 36,000 labor hours in 2024, equivalent to 4,500 workdays,” Phu said.

Through data, VietinBank offers online disbursement via VietinBank eFAST. Deputy CEO Tran Cong Quynh Lan said VietinBank processed over 87,000 online transactions worth more than VND270,000 billion, with 36 percent of disbursements done online.

Safe and on-target growth

With the government targeting 16 percent credit growth and 8 percent GDP growth rates in 2025, the task for banks is not only growth, but also selective and safe growth, and loans must reach to right addresses.

With the ability to automatically process and comprehensively evaluate credit profiles, AI analyzes data from multiple sources - finance, industry, credit behavior, market fluctuations, thus helping banks make quick, accurate decisions and minimize emotional decisions.

Amid Vietnam’s strong digital transformation wave, the concept of “living in a digital world” is becoming reality. However, successful digitization hinges not on technology but on people and secure digital identities.

In such conditions, Vietcombank, in collaboration with C06’s RAR Center under the Ministry of Public Security (MPS), has integrated VNeID digital signatures into VCB Digibank.

Beyond authentication, this allows individuals to apply for loans, disburse funds, and sign contracts anytime, anywhere, with no need to come to bank branches.

Vietcombank Deputy CEO Phung Nguyen Hai Yen said, “In a booming digital economy, unique, secure, and verified digital identities are critical for efficient, transparent, and legal digital transactions.”

Pham Anh Tuan, head of the Payment Department at the State Bank of Vietnam, said data is a core resource driving digital transformation and the digital economy.

SBV has directed banks and payment intermediaries to leverage citizen data, chip-based IDs, and VNeID for cleaner data, accurate customer verification, and safer, more convenient banking products. Over 113 million individual and 711,000 corporate profiles have been biometrically verified via chip-based IDs or VNeID. The National Credit Information Center (CIC) completed six offline verification rounds for about 57 million customer profiles.

Digital transformation in banking sector

SBV Governor Nguyen Thi Hong reported at the working session with the PM on digital transformation in late May that the interbank electronic payment system processes an average of VND820 trillion daily, while the financial switching and electronic clearing system handles 26 million transactions daily.

The national credit information infrastructure collects and updates data from within and outside the sector, with a data update success rate from credit institutions exceeding 98 percent.

Over 113 million individual and 711,000 corporate customer profiles have been biometrically verified (66 percent).

Many core banking services - savings deposits, term deposits, account openings, payment accounts, card issuance, e-wallets, fund transfers, and lending - are fully digitized at 100 percent. Many credit institutions in Vietnam achieve over 95 percent digital transaction rates.

Hoang Giap